Why DeUnity?

DeUnity: Where You Control the Token Universe — Build Your Market, Build Your Profit!

Are you ready for a complete financial transformation in DeFi?

Welcome to DeUnity — more than just an exchange. It’s an entire ecosystem of tools, where every step you take leads to new levels of control, profit, and financial freedom. Here, you won’t just follow someone else’s rules — you’ll become the creator and the driver of your own success.

Imagine a world where you’re not just a trader but the architect of financial systems.

What does DeUnity offer you?

• Automated Profit

With DeUnity’s smart hedging tools and leverage options, you can profit even in the most volatile markets. Your strategies work for you, so you don’t have to worry about risk.

• Token as an Exchange - DEX

You’re not just trading on a platform — you’re creating new, independent markets with your own Automated Market Makers (AMMs). Each token you launch becomes its own self-sustaining market that runs as an immutable contract until you decide otherwise.

• No LP Tokens

Forget complicated liquidity mechanisms. With DeUnity, your tokens power the entire process. You’re in full control, reducing dependency on third-party factors.

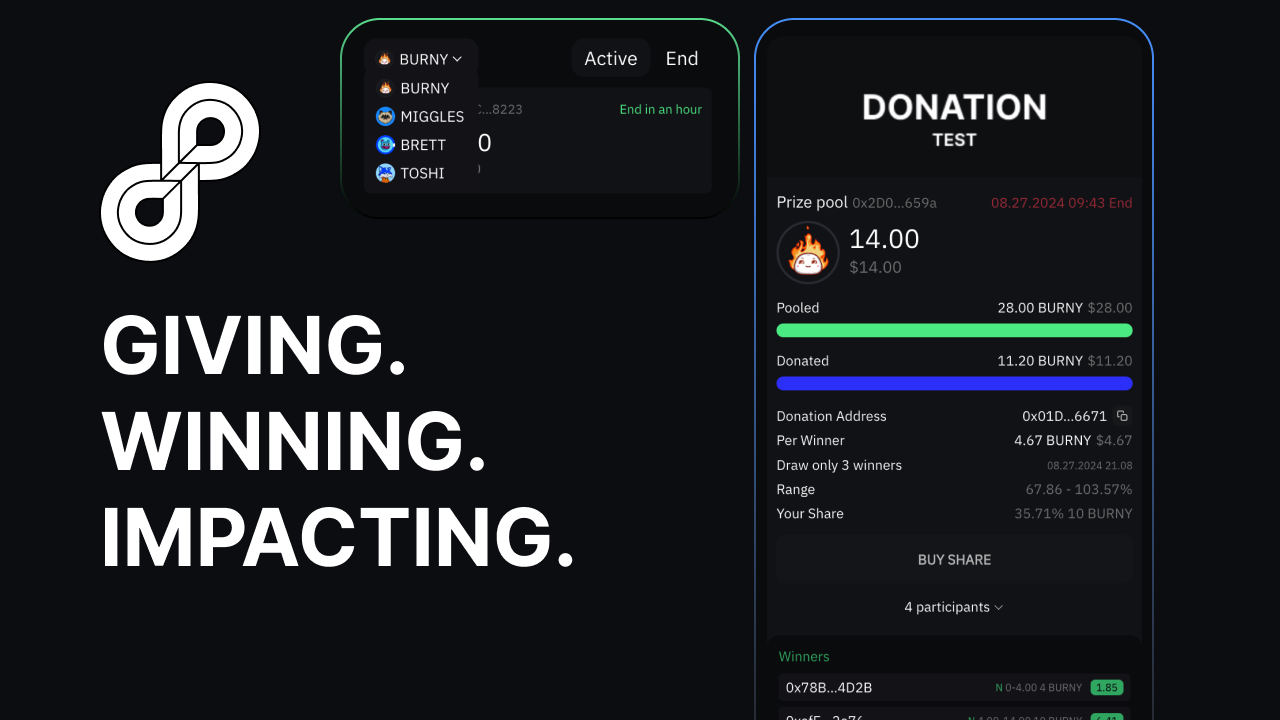

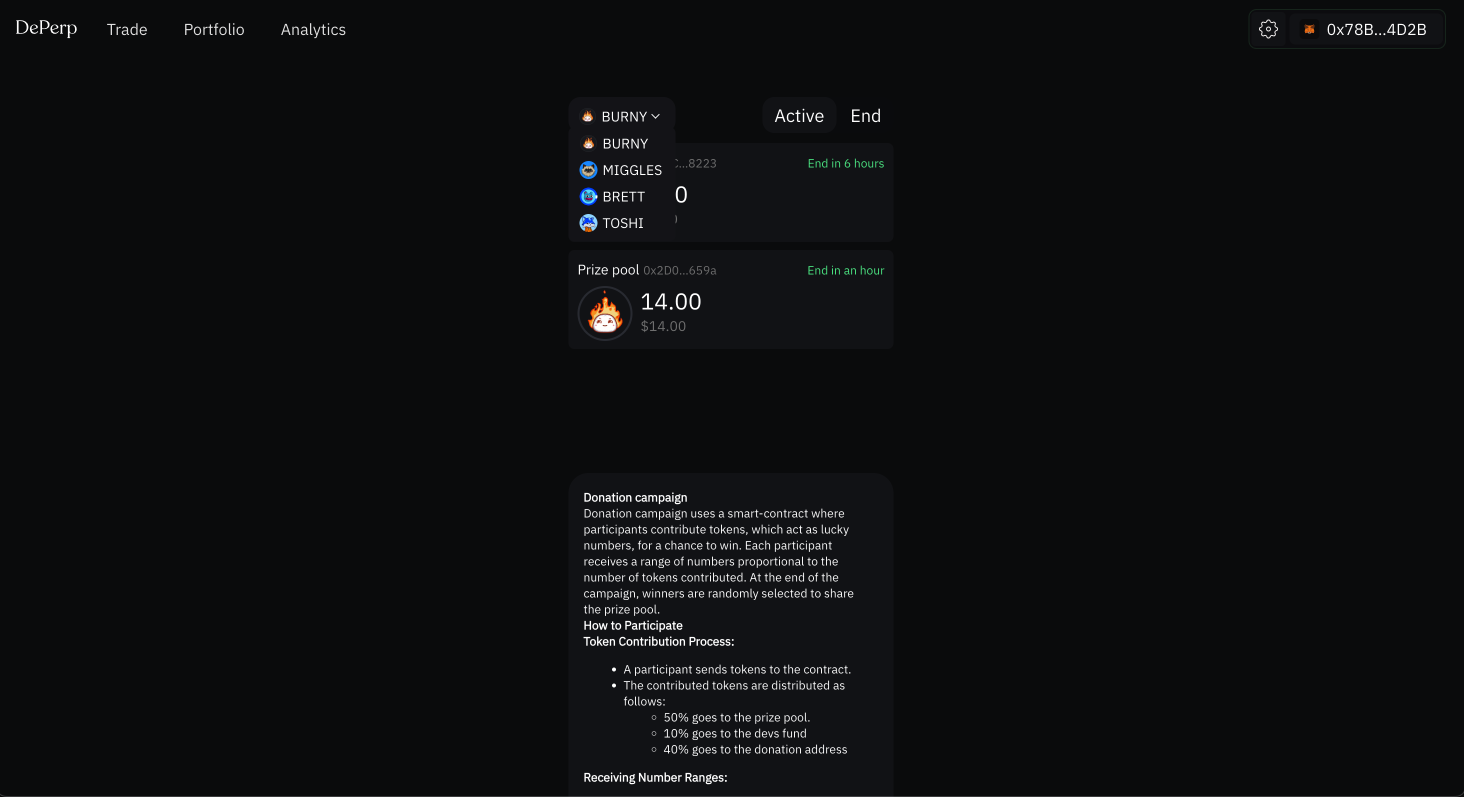

• Self-Launching Charitable Projects

Earn and change the world at the same time. Through DeUnity, you can not only trade but also participate in automated charitable campaigns that support causes like Make-A-Wish — making philanthropy a part of your financial journey.

Why do you need DeUnity?

- Independence with Full Responsibility

Ever dreamed of total freedom in financial markets? DeUnity gives you a unique opportunity to become the captain of your financial universe. Every token, every market is the result of your choices and your control.

- Automate Trading on Your Terms

You don’t need to sit in front of a screen all day, stressing over your positions. With DeUnity’s powerful hedging tools and algorithmic solutions, your profits work automatically while you focus on scaling up.

- Quick and Profitable Market Creation

Launching new markets has never been easier. Launch your token, and it immediately becomes part of a unique decentralized ecosystem. Each token operates like its own exchange, without the need for additional liquidity or complex setups.

- Risk-Free Leverage Trading

Want to boost your profits with less capital? In DeUnity, you can use leverage while minimizing risk through hedging. Trade confidently, knowing that smart algorithms protect your moves.

- Create and Earn at Every Step

In DeUnity, you’re not just part of the process — you drive it. Every action you take creates new earning opportunities and expands your markets. You’re not waiting for results, you’re making them happen.

Are you ready to be part of a new decentralized world?

Join DeUnity, where financial freedom and independence reach new heights. Here, you create your market, set your rules, and profits flow directly into your hands, until you decide to stop.

Don’t miss out:

Claim your airdrop for trading and creating tokens on Base. DeUnity is more than a platform. It’s a new way of looking at decentralized finance. You’re not just playing with the market. You’re moving it.

UNIT

Link

Link